The insurance industry has long faced challenges in making claims processing faster and more efficient. Traditionally, the process has been bogged down by manual paperwork, lengthy evaluations, and time-consuming investigations—leading to delays that frustrate both insurers and their customers. But that landscape is changing rapidly. Generative Ai for insurance is driving a new wave of innovation, transforming claims management into a faster, smarter, and more proactive process—one where delays and guesswork are minimized.

Think of traditional claims processing like a traffic jam: every car represents a claim stuck in a slow, manual system. Forms pile up, assessments take time, and frustration builds. Now imagine a fast-moving expressway, where data flows freely and decisions are made in real-time. That’s the power of generative AI combined with machine learning and large language models (LLMs). From the instant a claim is filed, AI systems can process huge volumes of both structured and unstructured data, summarize complex reports, and assist adjusters in making accurate decisions. This isn't just automation—it's augmentation. AI is complementing human expertise, boosting both efficiency and precision.

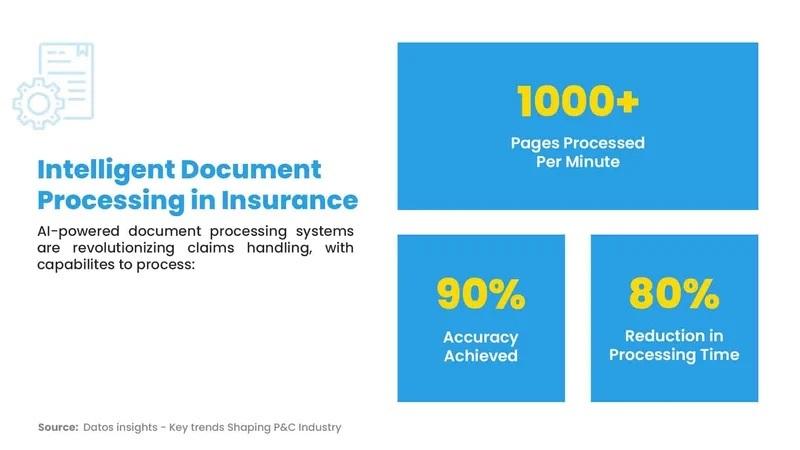

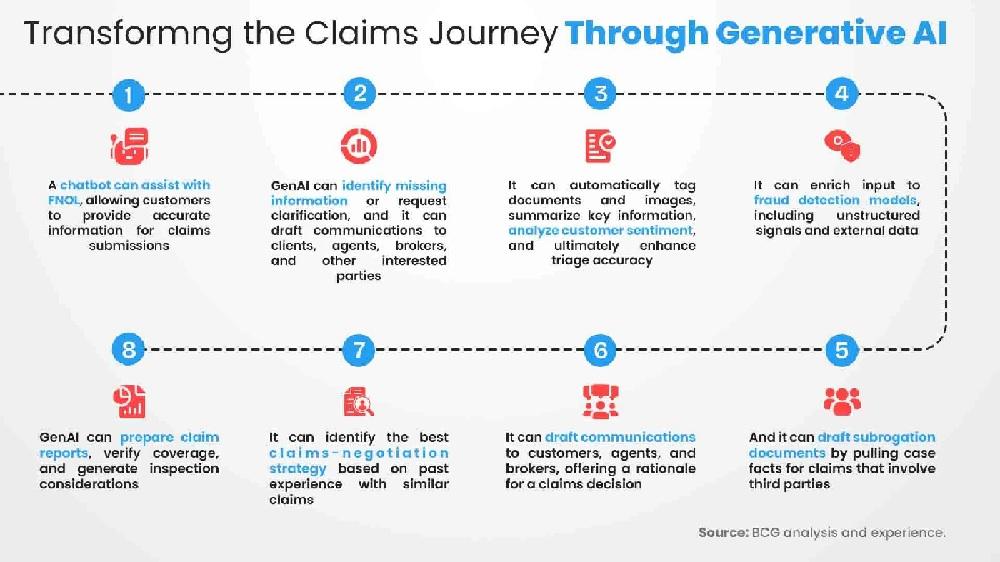

The results speak for themselves. AI-powered automation is optimizing the entire claims process—from the First Notice of Loss (FNOL) to final settlement. Some advanced AI-driven call centers can now process up to 90% of claims without any human involvement, cutting operational costs and resolution times dramatically. As more insurers adopt these technologies, we’re seeing a clear shift toward faster, more customer-focused service.

Neural Networks: The Backbone of Generative AI in Insurance

To appreciate the impact of Generative Ai for insurance, it's helpful to understand the underlying tech. Neural networks, inspired by how the human brain works, are the foundation of modern AI models. Picture a city grid where data travels across intersections (nodes), making decisions along the way based on learned behaviors. What makes it impressive is its ability to build new pathways as new information emerges. This is what allows generative AI not only to recognize patterns but to create new insights from the data it processes.

When you ask a question, a large language model doesn’t just pull an answer from a single source. It gathers insights from countless datasets, analyzing and stitching them together to form a well-informed and relevant response.

While traditional AI has been valuable in analyzing claims data, identifying risk patterns, and estimating costs, generative AI takes things further. It can interpret and make sense of unstructured information—like handwritten notes, emails, and even accident photos—transforming them into usable insights that streamline claims management.

How Generative AI Is Reshaping the Claims Lifecycle

Claims processing is one of the most critical and resource-intensive functions in insurance. It’s not just about handling payouts—it also influences customer satisfaction and retention. Today, insurers are turning to Generative Ai for insurance to reduce costs, accelerate processes, and enhance the overall claims experience.

At the heart of claims handling is the need to sift through massive amounts of data—policy documents, damage reports, prior case histories—to determine if a claim is valid. Generative AI can do this instantly, drawing on past data and learning from outcomes to evaluate new claims quickly and accurately.

A great example is Lemonade, a U.S.-based insurtech company that has taken automation to new heights. Its AI bot, AI Jim, is capable of reviewing claims, spotting fraud, and authorizing payouts in just seconds. By using generative AI, AI Jim pulls relevant details from customer statements, checks them against policy terms, and makes a payout decision—all with no human input. For more complex cases, AI Jim automatically flags the claim for a human adjuster, ensuring that nuanced scenarios get the attention they deserve. This approach significantly shortens processing time while enhancing both accuracy and customer satisfaction.