If all the stars align in your favour, you would effortlessly find the perfect house for sale in Welland, make an offer, and get the keys to your dream home without a hitch. However, in reality, things rarely fall into place so easily like this when buying a house. Since the home-buying process involves many steps, people, and moving parts, you will inevitably face some challenges and bumps when purchasing your first home. One such obstacle homebuyers often run into just before closing is appraisal issues. Sometimes, the home’s appraisal comes in higher or lower than the agreed price, which can benefit or challenge your position in the deal.

Can You Go Ahead With the Home Purchase Without an Appraisal?

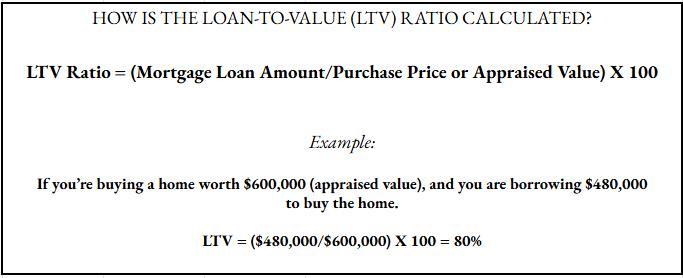

The appraisal process gives an independent estimate of the home’s value, ensuring you, the homebuyer, are not paying more than the house is worth. You can skip the appraisal process if you buy the house with cash, not a mortgage. But if you buy the house with a mortgage, your lender will typically require you to complete the appraisal process. Why? Because the property’s appraised value determines the loan-to-value ratio (LTV).

The Link Between Your Home’s Appraised Value and Loan-to-Value (LTV) Ratio

The loan-to-value (LTV) ratio is one of the key metrics lenders evaluate to understand the risk involved in your mortgage. This ratio compares the size of your loan to the home’s actual value, which the lender determines through the appraisal process. The higher your LTV ratio, the more you borrow relative to the home’s value and the riskier it is for the lender. If you default on the mortgage and the lender has to sell the house, they may not be able to recover the full loan amount, especially if the home value drops.

In short, lenders use the appraised value to calculate a borrower’s LTV ratio, which helps them analyse how risky the loan is. Most banks and credit unions in Canada approve loans with an LTV ratio as high as 95%. However, if the LTV ratio is above 95%, it raises red flags for the lender.

If the Appraiser Values the Homes at Less Than Your Offer

A low appraisal isn’t the kind of news you want to get as a homebuyer - it can throw a big wrench in your buying plans. That’s because the mortgage lenders use the appraised value, not the purchase price, to determine how much they will lend. Suppose you find a cheap house for sale in Welland, submit a $300,000 offer, and the seller accepts it. However, the appraisal report says the home is worth $280,000 - $20,000 lower than your offer. The lender will base the loan amount on the $280,000 appraised amount. You must figure out how to cover the $20,000 gap before the closing day.

Your Best Options When the Appraisal Comes in Low

1. Challenge the Appraisal with Strong Evidence

One of the first things you can do is challenge the appraised value by filing a Reconsideration of Value (ROV). The ROV basically means you are asking the appraiser to review and reconsider the appraisal.

2. Request a New Appraisal From a Different Professional

You can also ask your lender to order a second appraisal. This option gives you another shot at getting a higher value from a different appraiser, especially if you believe the first one didn’t assess the home properly.

3. Try to Negotiate With the Seller

Another route you can take is asking the seller to lower the house price to match the appraised value. You can also ask the seller to offer concessions if they don’t want to reduce the sale price outright. The seller could cover some of your closing costs, which can help free up cash on your end.

4. Cover the Appraisal Shortfall Out of Pocket

If none of the above options work and you really want the home, you can pay the difference in cash between the appraised value and the purchase price.

5. Walk Away From the Deal If It Doesn’t Work Out

Sometimes, the best move is to walk away from the deal, especially if you are not comfortable paying extra out of pocket or the seller won’t come to the table with flexibility. You can back out without losing your deposit if your purchase agreement includes an appraisal contingency.

If the Appraisal Comes in Higher Than Your Offer

Unlike a low appraisal, which can slow things down or even kill the deal, a high appraisal is actually great news for you as a homebuyer. Here is how a high home appraisal works in your favour -

● You Still Pay What You Offered - Nothing More

The seller does not get to raise the asking price if the appraised value exceeds the offer price. That means your budget stays intact, and you get a house that is officially worth more than what you are paying.

Let’s say you are buying a single-family home in Welland. The seller says yes to your $750,000 offer, and you sign the purchase agreement. However, if the appraisal report shows a value of $780,000, you can still buy that home for $750,000.

● You Instantly Gain Home Equity

Equity is the difference between what the home in Welland is worth and how much you still owe on your mortgage. So, using the example above, if the home's appraisal is $780,000, and you bought it for $750,000, that’s $300,000 in instant equity. This instant equity can help you qualify for a home equity loan or line of credit sooner.

● Helps You Save on Mortgage Insurance and Monthly Payment

Mortgage lenders require you to pay mortgage insurance if your down payment is less than 20% and the LTV ratio is above 80%. But with a higher appraisal, the home’s value increases, thus improving (reducing) your LTV ratio. If your LTV dips below the 80% mark, you will no longer need the mortgage insurance, and your mortgage payments will also go down. Your monthly mortgage payments could be much lower than what you saw in online mortgage calculator estimates and what you initially budgeted for.

Does a Higher Appraisal Give the Seller a Reason to Pull Out of the Sale?

The seller cannot cancel the deal if the appraisal value exceeds the offer price. Once you and the seller sign the agreement with the agreed-upon purchase price, it becomes a legally binding contract. The seller can back out only if your contract includes a specific clause allowing cancellations based on appraisal results, which is extremely rare.

Don’t Let Appraisal Issues Snag Between You and Your Dream Home

Did you know 21% of all delayed home purchases happen because of appraisal issues? Yes, that’s right! As a homebuyer, one of the best ways to avoid delays because of such appraisal issues is to be well-prepared. You must include an appraisal contingency in your offer and set aside some extra funds to cover a potential shortfall. Most importantly, work with a skilled realtor who truly understands the Welland real estate market and how to price offers correctly. Their expertise can make a significant difference in helping you avoid surprises and move through the process smoothly.