Zinc is one of the world’s most essential base metals, playing a critical role in a wide range of industrial applications. From galvanizing steel to producing die-cast components and manufacturing brass, zinc’s versatility and utility make it a vital material in global manufacturing. Its price trends, however, are subject to a variety of economic, industrial, and geopolitical factors. Understanding these price movements can offer valuable insights for producers, consumers, investors, and policymakers. In this article, we’ll explore the historical Zinc Price Trend, examine the forces behind recent fluctuations, and consider the factors likely to influence future trends.

Historical Overview of Zinc Pricing

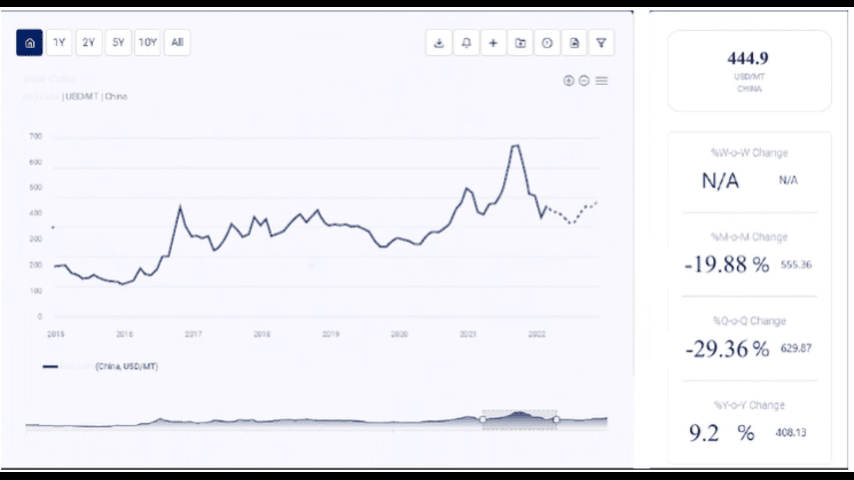

Historically, zinc prices have reflected broader trends in global industrial activity. As a heavily traded commodity, its price movements often align with economic cycles, shifts in supply and demand, and structural changes in the mining and smelting sectors.

-

Post-War Industrial Growth:

Following World War II, the global rebuilding effort and rapid industrialisation drove up demand for base metals, including zinc. Prices remained relatively stable as mining expanded, smelting technologies improved, and supply largely kept pace with demand. -

Energy Crises and Economic Shocks (1970s–1980s):

The oil shocks of the 1970s and subsequent economic turbulence caused disruptions across the metal markets. Higher energy costs impacted mining and smelting operations, while economic slowdowns led to reduced demand for industrial metals. Zinc prices experienced notable volatility during this period. -

China’s Economic Rise (2000s):

The early 2000s marked a transformative era for zinc. China’s rapid industrialisation and infrastructure boom created unprecedented demand for zinc-coated steel and other zinc applications. As China became the world’s largest consumer and producer of zinc, its influence on global prices increased dramatically. The period saw strong price growth, punctuated by volatility during the 2008 financial crisis.

Enquire For Regular Prices: https://www.procurementresource.com/resource-...ds/pricerequest

Key Drivers of Zinc Price Movements

Zinc prices are influenced by a combination of supply-side constraints, demand-side growth, and external macroeconomic factors. Key drivers include:

-

Global Demand for Galvanized Steel:

Approximately 50% of all zinc is used for galvanizing steel to prevent corrosion. Infrastructure projects, construction activities, and automotive manufacturing are major sources of demand. When these sectors grow, zinc prices often rise due to higher consumption rates. Conversely, economic slowdowns or declines in construction activity can soften demand and lead to price declines. -

Mining and Production Capacity:

Zinc prices are closely tied to the production levels of mining operations and smelters. Supply disruptions—caused by mine closures, labour strikes, or regulatory changes—can reduce availability and drive up prices. On the other hand, new mining projects or increased production capacity can lead to a surplus, exerting downward pressure on prices. -

Energy and Input Costs:

The energy-intensive nature of zinc smelting means that energy prices can significantly impact production costs. Higher electricity or fuel costs increase smelting expenses, potentially pushing prices upward. Similarly, rising costs for other inputs, such as chemicals and labour, can influence overall pricing trends. -

Stock Levels and Inventory Dynamics:

Zinc inventories in major metal exchanges (such as the London Metal Exchange, LME) serve as a barometer for supply-demand balance. Low stock levels indicate tighter supply and typically support higher prices. Conversely, rising inventories suggest oversupply, often leading to lower prices. -

Geopolitical and Trade Factors:

Trade restrictions, tariffs, and geopolitical tensions can disrupt zinc supply chains. For instance, sanctions on a key producing region or tariffs on zinc imports can limit availability and drive price increases. Stable trade relations and consistent supply chains tend to moderate price volatility. -

Currency Fluctuations and Economic Indicators:

As zinc is priced in U.S. dollars, currency exchange rates play a role in its affordability. A stronger dollar can make zinc more expensive for buyers using other currencies, potentially dampening demand and lowering prices. Conversely, a weaker dollar can support higher prices. Broader economic indicators—such as global GDP growth, industrial production indices, and manufacturing data—also provide signals about potential demand shifts.

Recent Trends and Developments

-

COVID-19 and Market Volatility:

The COVID-19 pandemic disrupted the zinc market in multiple ways. Initially, industrial slowdowns and construction halts led to a drop in demand and prices. However, as economies reopened and governments implemented stimulus measures, demand for galvanized steel and other zinc applications rebounded. Supply chain challenges, including shipping delays and labour shortages, contributed to price fluctuations. -

Decarbonisation and Green Initiatives:

Efforts to reduce carbon emissions have influenced the zinc market. Investments in renewable energy infrastructure, electric vehicle manufacturing, and energy-efficient buildings have increased demand for galvanized steel. At the same time, stricter environmental regulations on mining and smelting have constrained supply, supporting higher prices. -

China’s Role and Policy Shifts:

China remains the dominant force in the zinc market, both as a producer and consumer. Government policies, environmental restrictions, and changes in industrial activity in China can cause significant price swings. For example, production cuts to meet environmental targets have reduced supply, while strong demand from the construction and automotive sectors has supported higher prices.

Future Outlook for Zinc Prices

Several factors are likely to shape the trajectory of zinc prices in the coming years:

-

Infrastructure Investment:

As countries continue to invest in infrastructure projects, especially in developing economies, demand for galvanized steel and other zinc applications is expected to remain strong. Major infrastructure initiatives in Asia, Africa, and South America could support sustained price growth. -

Green Technologies and Renewable Energy:

The transition to renewable energy sources and the expansion of electric vehicle production are likely to drive additional demand for zinc. Applications such as wind turbines, solar panel frames, and electric vehicle components rely on zinc-coated materials, which could bolster long-term demand and pricing. -

Supply Constraints and Environmental Regulations:

Environmental regulations are expected to remain stringent, potentially limiting zinc production in certain regions. This could lead to tighter supply conditions, supporting higher prices. At the same time, the development of more sustainable mining and smelting practices may help stabilise production over time. -

Economic Recovery and Global Trade:

The pace of global economic recovery, particularly in the wake of the COVID-19 pandemic, will be critical. Strong growth in manufacturing and construction sectors could push prices upward. Meanwhile, trade policies and geopolitical stability will play a role in ensuring a steady supply and reducing volatility.

Zinc price trends are shaped by a complex web of supply, demand, and external influences. By examining historical patterns, key drivers, and recent developments, stakeholders can gain a better understanding of the forces that move the market. As global economies continue to evolve, zinc will remain a vital material, with its price trends reflecting the shifting dynamics of industrial activity, environmental goals, and technological advancements.

Contact Us:

Company Name: Procurement Resource

Contact Person: Leo Frank

Email: sales@procurementresource.com

Toll-Free Numbers:

-

USA & Canada: +1 307 363 1045

-

UK: +44 7537171117

-

Asia-Pacific (APAC): +91 1203185500

Address: 30 North Gould Street, Sheridan, WY 82801, USA