Saudi Arabia Fintech Market Insights & Analysis

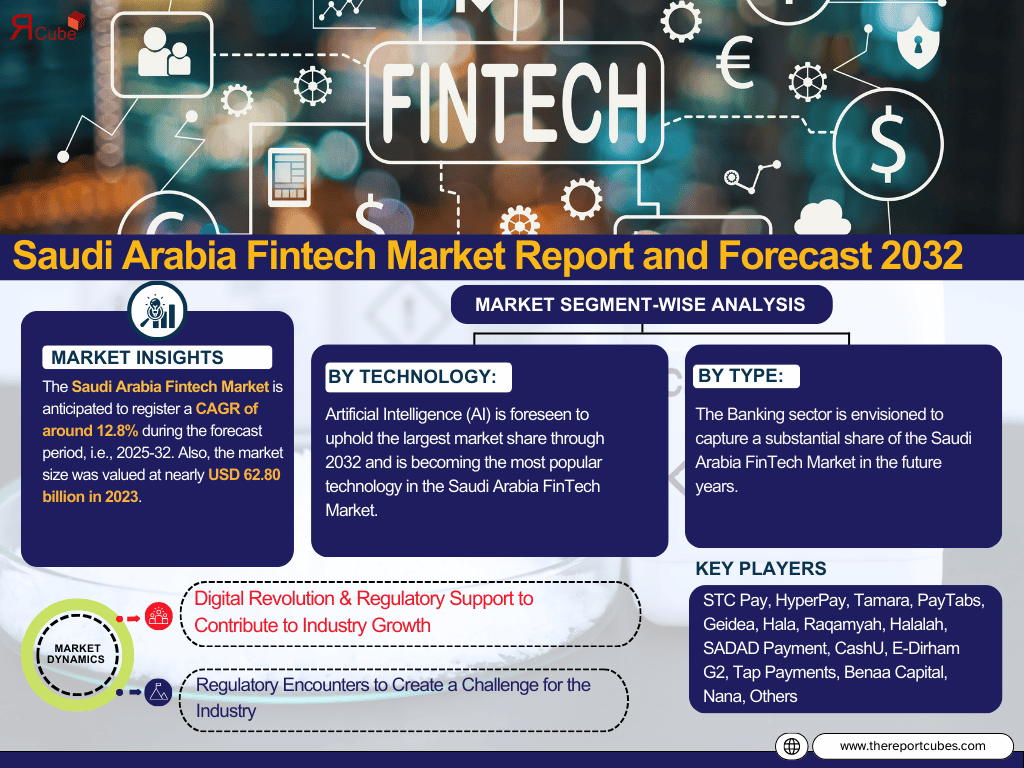

The Saudi Arabia Fintech Market is anticipated to register a CAGR of around 12.8% during the forecast period, i.e., 2025-32. Also, the market size was valued at nearly USD 62.80 billion in 2023. The Saudi Arabian fintech business has expanded at a rapid pace owing to the widespread usage of smartphones & the penetration of internet connection. By making financial services more readily available & easy, fintech companies have been able to attract an extensive range of customers attributable to the nation’s enormous population. Also, the demand for creative financial solutions is being driven by the country’s youthful, tech-savvy populace, which utilizes mobile devices & the internet extensively.

Get a Free Sample Report with Table of Contents - https://www.thereportcubes.com/request-sample/saudi-arabia-fintech-market

What Information Does the Saudi Arabia Fintech Market Research Report Covers?

The research report highlights:

· The Saudi Arabia Fintech Market research study is a well-crafted study that draws from both primary & secondary data sources.

· Examine supply & demand dynamics, development trends, competition landscapes, brand share and pricing analysis, growth patterns from year to year, and the progress of leading market players.

· Focus on determining the areas and niche markets with the most growth potential.

· Aids in getting a thorough grasp of the competitive environment, including the distribution of market shares, important companies (premier, laggard, innovator, and start-up), and their advantages & disadvantages.

· To assist stakeholders in uncovering the market’s potential growth factors, the industry is deeply analyzed in terms of segmentations, regional study, SWOT analysis, and Porter’s Five Forces Analysis.

Read Full Report with Table of Contents - https://www.thereportcubes.com/report-store/saudi-arabia-fintech-market

Saudi Arabia Fintech Market Dynamics

- Digital Revolution & Regulatory Support to Contribute to Industry Growth

Owing to several significant variables, the Saudi Arabia FinTech Market is projected to expand rapidly during the forecast period. The country's digital revolution fosters an atmosphere, favorable to the development of fintech companies. The mounting number of digital banking and payment options, which are rapidly gaining traction with customers is proof of this. Also, a regulatory sandbox has been established to elevate innovation as part of the Saudi Arabian Monetary Authority's (SAMA) active support of the fintech industry's growth. Further, investments & interest in fintech as a major progression area are also driven by the government's Vision 2030 strategy, which seeks to diversify the economy, away from oil. Thus, infusing the Saudi Arabia Fintech Market growth over the years.

Who are the Major Competitors Across the Market?

The underlying forces of any market are molded & influenced by its leading companies. Consumer preferences, competition, market trends, and the ecosystem as a whole are all significantly impacted by their interactions, tactics, and whereabouts. Some of the leading market players are:

- STC Pay

- HyperPay

- Tamara

- PayTabs

- Geidea

- Hala

- Raqamyah

- Halalah

- SADAD Payment

- CashU

- E-Dirham G2

- Tap Payments

- Benaa Capital

- Nana

- Others

How is the Saudi Arabia Fintech Market Examined in Terms of Segmentation?

By Technology:

- Application Programming Interface (API)

- Artificial Intelligence (AI)

- Blockchain

- Robotic Process Automation

- Data Analytics

- Others

Artificial Intelligence (AI) is foreseen to uphold the largest market share through 2032 and is becoming the most popular technology in the Saudi Arabia FinTech Market.

By Type:

- Banking

- Insurance

- Securities

- Others

The Banking sector is envisioned to capture a substantial share of the Saudi Arabia FinTech Market in the future years. Fintech adoption has been stipulated by the swift digital transformation of the country’s banking sector, which has been pushed by government initiatives & the growth of mobile banking.

Key Questions Analyzing the Saudi Arabia Fintech Market Research Report. 2032

· Which are the major companies across the Saudi Arabia Fintech Market?

· What would be the CAGR of the Saudi Arabia Fintech Market in the forecast years, 2025-2032?

· How big is the Saudi Arabia Fintech Market anticipated to be in the upcoming years?

· What market segment will dominate the healthcare staffing industry?

· What changes can we expect to see in market development trends over the next five years?

· What kind of competitive environment does the Saudi Arabia Fintech Market have?

· Which strategies are most commonly employed in the Saudi Arabia Fintech Market?

About Us-

At Report Cube, we are more than just a market research company; we are your strategic partner in unlocking the insights that drive your business forward. With a passion for data, a commitment to precision, and a dedication to delivering actionable results, we have been a trusted resource for businesses seeking a competitive edge.

Our mission is to empower businesses with the knowledge they need to make informed decisions, innovate, and thrive in an ever-evolving marketplace. We believe that data-driven insights are the cornerstone of success, and our team is dedicated to providing you with the highest quality research and analysis to help you stay ahead of the curve.

Media Contact

Company Name: The Report Cube

Email: sales@thereportcubes.com

Contact Number: +971 564468112 (WhatsApp)

Address: Burjuman Business Tower, Burjuman, Dubai

Website: https://www.thereportcubes.com/